The oil market is grappling with intensifying geopolitical risks as uncertainty swirls over the impact of tensions surrounding nations such as Iraq, Iran and the U.S., according to Goldman Sachs Group Inc.

While Iraq’s government is clashing with Kurdish forces in the north of the OPEC nation, raising the prospect of output disruptions in the region, both sides have an incentive to keep oil flowing due to low production costs and “high revenue” available per barrel, according to the bank. And though the U.S. has hardened its stance against Iran, there’s still “high uncertainty” over whether it’ll reimpose sanctions curbing the Middle East country’s crude supply.

Oil jumped almost 3 percent over the past two sessions as weeks of tensions following a Kurdish referendum on independence from Iraq on Sept. 25 flared into open conflict in the oil-rich Kirkuk region. Still, the rally fizzled on Tuesday, with prices trading little changed, as two fields pumping a combined 275,000 barrels a day were shut amid the violence.

“The limited market response so far is therefore consistent with the high uncertainty on potential production disruptions, with larger moves only likely to occur should new disruptions actually occur,” Goldman analysts including Damien Courvalin wrote in a October 17 research note.

The tensions are intensifying at a time when the fall in Venezuelan output appears to be accelerating, and as continued political instability in Libya and Nigeria threaten supplies, according to the bank.

The $1.50-a-barrel rally in Brent crude, the benchmark for more than half the world’s oil, since Friday morning could be interpreted as reflecting expectations for an outage of 250,000 barrels a day over three months, Goldman said.

Given the still elevated uncertainty on oil disruptions occurring, it could also be seen as a reflection of a 30 percent probability of a six-month 500,000 barrel-a-day disruption, according to the bank.

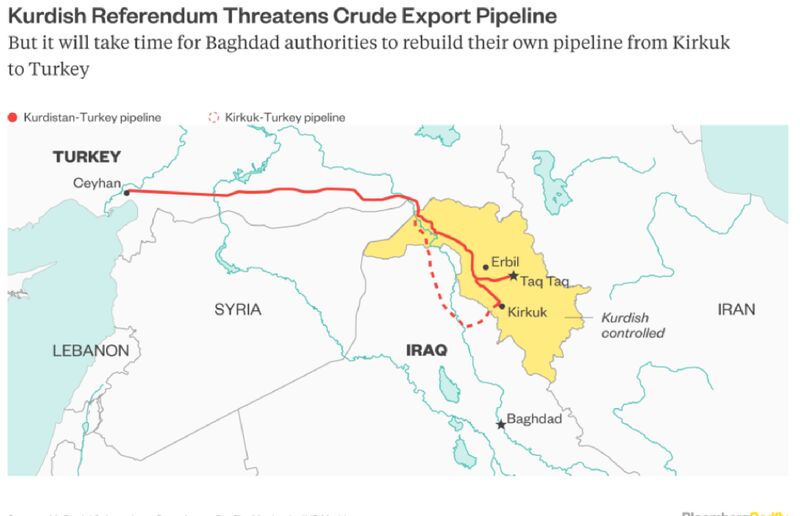

Baghdad piggybacks its exports from Kirkuk with Kurdish shipments through a pipeline — run by the semi-autonomous Kurdistan Regional Government — that transports crude to the Mediterranean port of Ceyhan in Turkey. Iraq, the second-largest producer in the Organization of Petroleum Exporting Countries, pumps most of its 4.47 million barrels a day from fields in the south and ships it from the Persian Gulf port of Basra.

Iraq can benefit from higher revenues for the oil only if it reaches an agreement with the KRG and “Turkey does not interrupt flows through its port of Ceyhan,” Goldman said. Yet this doesn’t rule out sustained production disruptions as Iraq has less downside risk, given its southern exports, than the KRG if flows to Ceyhan are interrupted and global oil prices rally, according to the bank.

In the case of Iran, Goldman said while “several hundred thousand barrels of Iranian exports” would be immediately at risk if secondary U.S. sanctions were reintroduced, it sees no immediate impact on oil flows. “Without the support of other countries, it appears unlikely that production would fall by one million barrels a day” to levels before world powers reached a deal with the Persian Gulf state to curb its nuclear program, the bank’s analysts said.

Report courtesy Bloomberg