Nigerian bank stocks in stellar performance, gain 154.5% in price appreciation y-o-y

January 19, 20181.5K views0 comments

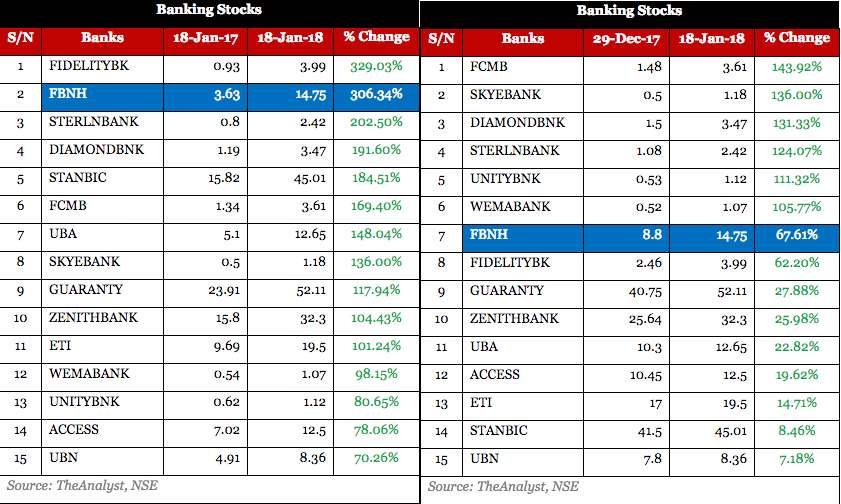

Banking stocks dominated the Nigerian equities market and remained the toast of most investors in 2017, chalking up average price gains of 154.5 percent year-on-year as at January 18, 2018, according to a review of the market by Proshare.

The banking stocks led among the stocks listed within the financial services sector in particular and the stock market in general.

The review of the share price performance of the 15 banking stocks listed on the exchange in the past year indicated that they are all traded in the green zone.

FIDELITYBK and FBNH topped the chart with 329.03% and 306.34% price appreciation respectively while ACCESS and UBN recorded the least price growth with 78.06 percent and 70.26 percent.

Read Also:

- Operations, management of Nigerian airports rejigged for innovation, ideas

- Alebiosu, banking veteran, replaces Adeduntan as First Bank MD/CEO

- Nigerian student pioneers agritech solution to address agricultural…

- Nigerian Breweries on track to seal Distell Wines & Spirits deal by H1 2024

- Adeduntan leaves after 9-years leading Nigeria’s oldest bank

Specifically, FIDELITYBK opened trading on January 18, 2017 at N0.93 but on January 18, 2018 the share price closed at N3.99, representing 329.03 percent appreciation. This is ditto for FBNH, which opened in the same period of last year at N3.63 to close at N14.75 on January 18, 2018. Other banking stocks prices equally moved in the same direction. See Table.

Similarly, a review of the share price performance of all banking stocks year to date also revealed that they are all also trading in the green zone.

FCMB and SKYEBANK topped the chart with 143.92 percent and 136.00 percent price growth respectively while STANBIC and UBN recorded the least growth with 8.46 percent and 7.18 percent respectively.

See Table.

Also, an analysis of market performance in 2017 indicates that total market capitalisation stood at N13.62 trillion compared to the N9.25 trillion level as at the last day of trading in 2016. This signifies a growth of 47.29 percent year-on-year.

A sectoral appraisal of market capitalization for the review period revealed that the financial services sector emerged the most capitalized sector with a market cap of N4.31 trillion representing 31.62 percent of total market capitalization.

Banks stocks principally drove the performance of the financial services sector while insurance stocks remained flat in the year.