Digital finance seen driving Nigeria’s economic growth by 12% in a decade, says McKinsey

Steve Omanufeme is Businessamlive Managing Editor.

You can contact him on steveo@businessamlive.com with stories and commentary.

July 14, 20172.3K views0 comments

The Nigerian economy has potential of growing by as much as 12 percent in less than a decade if the government takes heed to a new report by McKinsey Global Institute (MGI) and broaden the country’s access to digital finance tools, including having payments and financial services delivered via the phone and the Internet.

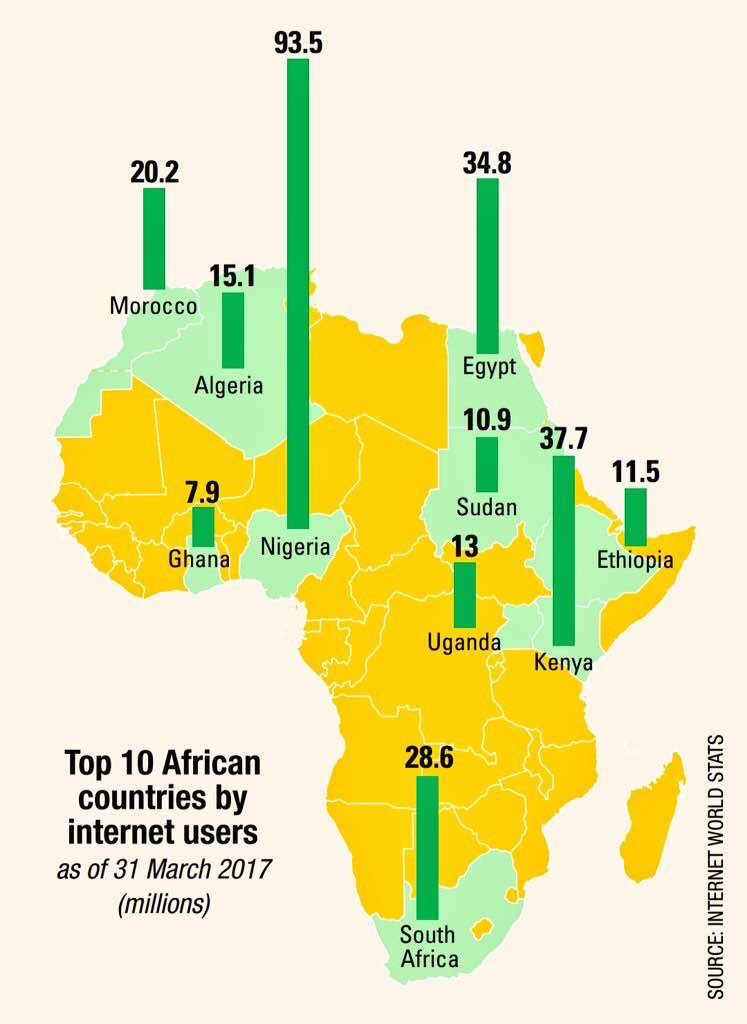

Nigeria is the biggest country in Africa by population and economy size and also leads the continent in the number of active mobile phone lines and number of Internet users, but would require a well articulated policy push in digital finance, where it has struggled to set a proper framework its operation, for it to achieve the McKinsey projected growth number.

A new report, “Digital finance for all: Powering inclusive growth in emerging economies”, one of the first attempts to quantify the full impact of digital finance, asserts that delivering financial services by mobile phone could benefit billions of people by spurring inclusive growth that adds $3.7 trillion to the GDP of emerging economies within a decade.

“The economic potential varies significantly, depending on a country’s starting position. Lower-income countries such as Ethiopia, India, and Nigeria have the largest potential, with the opportunity to add 10 to 12 percent to their GDP, given low levels of financial inclusion and digital payments today,” the report highlighted.

Read Also:

- RIMSON canvasses risk management principles for Nigeria’s economic growth

- Nigeria banks on low-interest $2.25bn World Bank loan to boost economic recovery

- PETs as guardians of our digital world

- Gavi, global vaccine alliance, generated $220bn in economic benefits for…

- Cross River banks on fresh management team to boost economic development

It said that Pakistan has a somewhat lower GDP potential, at seven percent, while Middle-income countries such as Brazil, China, and Mexico could add 4 to 5 percent to GDP—still a substantial boost.

The report noted that two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today, lack access to savings and credit, that even those with access often pay high fees for a limited range of products while economic growth suffers.

“But a solution is right in people’s hands: a mobile phone,” it said, adding that digital finance—payments and financial services delivered via mobile phones and the Internet—could transform the lives and economic prospects of individuals, businesses, and governments across the developing world, boosting GDP and making the aspiration of financial inclusion a reality.

According to the report, digital payments and financial services are part of the vital infrastructure of a modern economy, enabling individuals, businesses, and governments to transact cheaply and efficiently.

“For a range of companies, including banks, telecommunications companies, payments providers, financial-technology startups, retailers, and others, the potential business opportunity is large. In most countries, which players will dominate, is still up for grabs,” the report noted, adding that the opportunity to accelerate inclusive growth could be addressed rapidly and without the need for major investment in costly additional infrastructure.

In addition to extensive economic modeling, the report draws on the findings of field visits to seven countries—Brazil, China, Ethiopia, India, Mexico, Nigeria, and Pakistan—and more than 150 expert interviews. It also lays out the key conditions that will need to be met to capture the benefits.

See also: Nigeria ranks 21 in world’s most powerful economies in 2030

The research finds that widespread adoption and use of digital finance could increase the GDPs of all emerging economies by six percent, or a total of $3.7 trillion, by 2025. This is the equivalent of adding to the world an economy the size of Germany, or one that’s larger than all the economies of Africa. This additional GDP could create up to 95 million new jobs across all sectors of the economy.

“Digital finance could provide access to 1.6 billion unbanked people, more than half of them women. An additional $2.1 trillion of loans to individuals and small businesses could be made sustainably, as providers gain newfound ability to assess credit risk for a wider pool of borrowers.

“Governments could gain $110 billion per year by reducing leakage in public spending and tax collection. Providers of financial services would benefit, too,” the report said.

The research points out that governments stand to save $400 billion annually in direct costs by shifting from traditional to digital accounts, which can be 80 to 90 percent less expensive to service.

Equally, by expanding their customer base, providers increase revenue opportunities and could sustainably increase their balance sheets by as much as $4.2 trillion.

“To capture the opportunity, businesses and government leaders will need to make a concerted and coordinated effort. Three building blocks are required: widespread mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that meet the needs of individuals and small businesses in ways that are superior to the informal financial tools they use today,” the report advised.

The report also noted that widely used digital finance has the power to transform the economic prospects of billions of people and inject new dynamism into small businesses that today are held back for lack of credit.

“Rather than waiting a generation for incomes to rise and traditional banks to extend their reach, emerging economies have an opportunity to use mobile technologies to provide digital financial services for all, rapidly unlocking economic opportunity and accelerating social development,” it noted.