Forte Oil’s N20bn share sale: Analysis shows offers little or nothing to investors

June 19, 20171.9K views0 comments

ANALYSIS

Downstream oil and gas firm, Forte Oil Plc, which also plays in the power generating space, recently disclosed plans to raise N20 billion in new capital by way of a share sale.

The disclosure was given last week by Julius Omodayo-Owotuga, the company’s executive director and group chief financial officer (CFO).

“We have commenced preparation to raise additional capital. As we see opportunities, we continue to explore them and raise money in tranches. This series provides us with the necessary liquidity to actualise our growth strategy and position the company for the years ahead.”

While the CFO may be doing his job in talking up the company ahead of the share sale, an indepth analysis by Businessamlive indicates the capital raising would only amount to share diluting and nothing more.

Read Also:

We at Businessamlive are not particularly impressed by the prospects of Forte Oil without clarity on just what the share diluting capital raising tends to achieve.

We therefore decided to look at FOs most recent quarter (Q1) 2017 to get a clue.

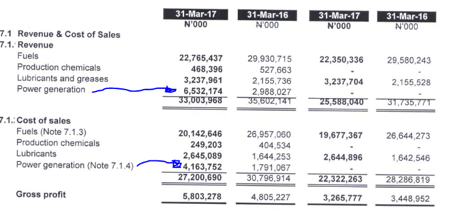

First of all, we see that group revenues are down year-on-year to N33 billion in Q1, 2017 compared to N35.6 billion in the corresponding quarter of last year.

The second thing that jumped at us was that while FO declared a profit of N1.88 billion for the Q1, 2017 period only 37 percent of that (N702 million) actually belongs to shareholders of the company.

Yes that is absolutely right and can be seen in Fig 1 below

Fig 1: FO PROFIT & LOSS ACCOUNTS Q1, 2017

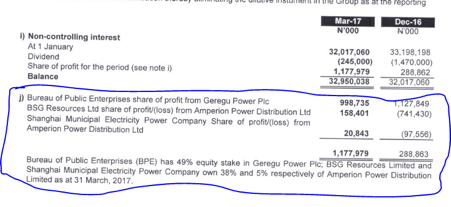

The reason for this is that non-controlling interests in the form of the BPE, BSG resources and Shanghai municipal electric company own about 63 percent of the Geregu power plant which is a high margin business of FO (see Fig 3).

Fig 2: NON CONTROLLING INTERESTS

Fig 3: FO Segment Analysis

From the chart above we can see that cost of sales as a percentage of revenues is 88.4% for the fuels segment, 81.7 % for the Lubricants segment and 63.7% for power generation.

What this means is that FOs most profitable assets do not fully belong to the company and if the capital raising is used to expand capacity in low margin assets then the pay-off is probably doubtful for shareholders.

What then can FO do to boost shareholder value through the share sale?

One way would be to try and pay down its huge debt burden of N47 billion as at Q1, 2017 with money raised from an equity sale.

The severity of the debt burden can be seen as FOs finance costs increased by 40% to N2.1 billion in Q1, 2017 compared to N1.519 billion in Q1, 2016.

The rise was due to spike in interest on bonds and interest on bank loans and overdrafts.

The N47 billion debt burden is also 18 times FO full year 2016 net income of N2.63 billion making it largely unsustainable.

With an effective tax rate of 8% due to a yet to be granted application for extension of Geregu Power pioneer tax status, which expired last year, FO profits could take a hit from a normalised company income tax rate of around 27% which it paid in 2016.

Forte Oil has 1.3 billion shares outstanding and its share price closed at N55.58 per share on Thursday.

We calculate that the firm needs to issue 360 million new shares at this price to raise N20 billion.

We would not be buyers of this share sale due to the numerous issues raised above and shareholders may probably need to take heed.