Venezuelan bonds decline on speculation the U.S. will ban trading

August 23, 20171.2K views0 comments

Investors in Venezuela have a new worry keeping them up at night: the White House.

For years, traders have ridden out economic recession, street protests and the threat of political collapse in a nation where reliable data is hard to come by. Now they’re weighing another factor: what comes next from Donald Trump’s administration as U.S. officials weigh options to punish Nicolas Maduro’s government for undermining the nation’s democracy.

Bonds from the sovereign and its state oil company dropped Wednesday, with some securities reaching an 18-month low, after a fresh report that the U.S. government is considering a ban on trading some Venezuelan securities. Doing so would leave bond holders stuck with the notes during a tumultuous period for the country.

“An immediate ban would be worse than a default,” said Ray Zucaro, the chief investment officer of Miami-based RVX Asset Management. “Oftentimes after a default liquidity improves. A ban would lock people with what they had. They would have no way out.”

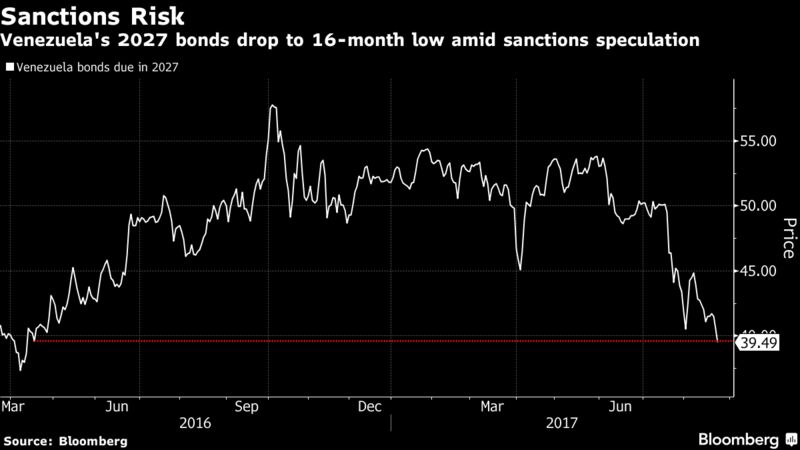

Benchmark government notes due in 2027 dropped 1.06 cents to 39.49 cents on the dollar, while Petroleos de Venezuela SA notes maturing in November slumped 1.48 cents to 89.07 cents. The longest-maturity PDVSA securities, due in 2037, fell below 30 cents.

Additional sanctions being considered may ban U.S.-regulated financial institutions from buying and selling securities from Venezuela or PDVSA, the Wall Street Journal reported Tuesday. Investors are also speculating that restrictions could instead target specific bonds such as Venezuela’s 2036 notes, which are held by a state bank, or the infamous hunger bondsthat Goldman Sachs’s asset-management unit bought in May at a deep discount, according to Zucaro.

In recent weeks the U.S. has slapped a raft of sanctions on Venezuelan officials, including Maduro, as the socialist government moved to consolidate power amid months of bloody protests and a crippling recession. The nation’s bonds have posted the world’s biggest losses since mid-July as concern grew that the chaos enveloping the country would imperil debt payments and as speculation mounted that the U.S. could impose stiffer penalties.

Some bond holders see the Venezuela rumor mill as more of a distraction than anything useful.

“We’re not in the business of trying to speculate about what the U.S. government may or may not do,” said Jan Dehn, the head of research at London-based Ashmore Group Plc, which oversees about $58 billion of assets. “If we were to trade on the endless speculation, it would completely distract from our work of understanding the risks in Venezuela.”