Barclays Plc said it will sell a further 22 percent stake in its South African unit, a holding worth about $2 billion at current prices, as part of the U.K. bank’s plan to shrink its operations and bolster capital strength.

The London-based lender is offering about 187 million shares of Barclays Africa Group Ltd. in an accelerated bookbuild after it received approval from South African authorities, it said in a statement Wednesday. The bank has demand for all the shares on offer, according to a person with knowledge of the plan. Barclays, which currently holds 50.1 percent of Barclays Africa, said it has a long-term target of reducing its shareholding in the unit to 15 percent.

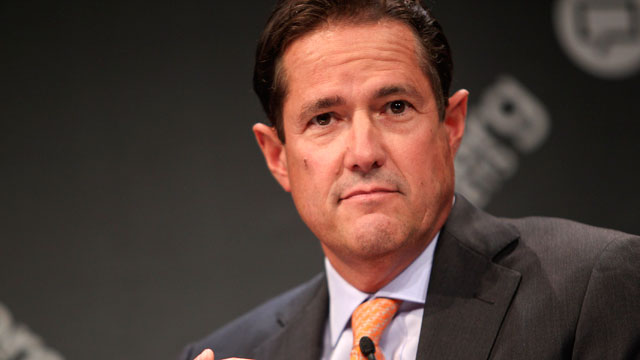

The placement marks the second phase of Barclays’s plan to gradually sell down its stake and deconsolidate the unit from its accounts, releasing capital that can be invested elsewhere in the business. Chief Executive Officer Jes Staley, 60, decided to reduce the lender’s presence on the continent in favor of supporting a trimmed-down investment bank focused on London and New York.

“Regulatory approval for the separation” is “a key milestone in the execution of our strategy and the restructuring of Barclays,” Staley said in an email.

Public Investment Corp., South Africa’s biggest money manager, plans to purchase a 7 percent stake through the sale, subject to regulatory approvals. The state-owned money manager was prevented from following through on its intention of buying a bigger stake because of regulatory issues, Johannesburg-based newspaper Business Report said, citing PIC CEO Dan Matjila.

Barclays Africa shares fell 4.8 percent to 139 rand in Johannesburg on Wednesday.

Gordhan firing

The second sale follows the disposal of a 12.2 percent stake to fund managers in South Africa and abroad in May 2016. The latest phase was said to have been delayed after South African President Jacob Zuma fired Finance Minister Pravin Gordhan at the end of March, replacing him with Malusi Gigaba. Gordhan had given provisional approval to a separation agreement that involves the U.K. lender paying its subsidiary 765 million pounds ($987 million).

Barclays will also contribute 110 million pounds to help establish a “broad-based black economic empowerment scheme” in the country as part of the separation, the lender said in a separate statement Wednesday. The bank said it expects more costs to be incurred during the transition process after taking an 884 million-pound writedown on the division in the first quarter.

The British bank, which has had a presence on the continent for more than 100 years, first bought a controlling stake in the South African lender in 2005 when the Johannesburg-based company was still called Absa Group Ltd. It paid $5.4 billion for a 60 percent holding. That stake increased to more than 62 percent in 2013 as part of a reshuffle that saw Absa take over Barclays’s operations in eight African countries.

Deconsolidating Africa will boost Barclays’s common equity Tier 1 ratio, the key measure of capital strength, by at least 0.75 percentage point from 12.5 percent at the end of March, the bank has said.

The share placement is being coordinated by Barclays itself, aided by Citigroup Inc., Deutsche Bank AG and UBS Group AG, according to the statement. Barclays can’t sell any more Barclays Africa stock for 90 days after the latest placement is settled, a provision known as a lock-up restriction.

Courtesy Bloomberg