The International Energy Agency (IEA) says the Organization of Petroleum Exporting Countries (OPEC) won’t clear the global oil glut anytime soon since any increase in price continues to bolster rival production from U.S. shale, that Nigeria and Libya are part of the challenges facing the organisation’s effort to curb production.

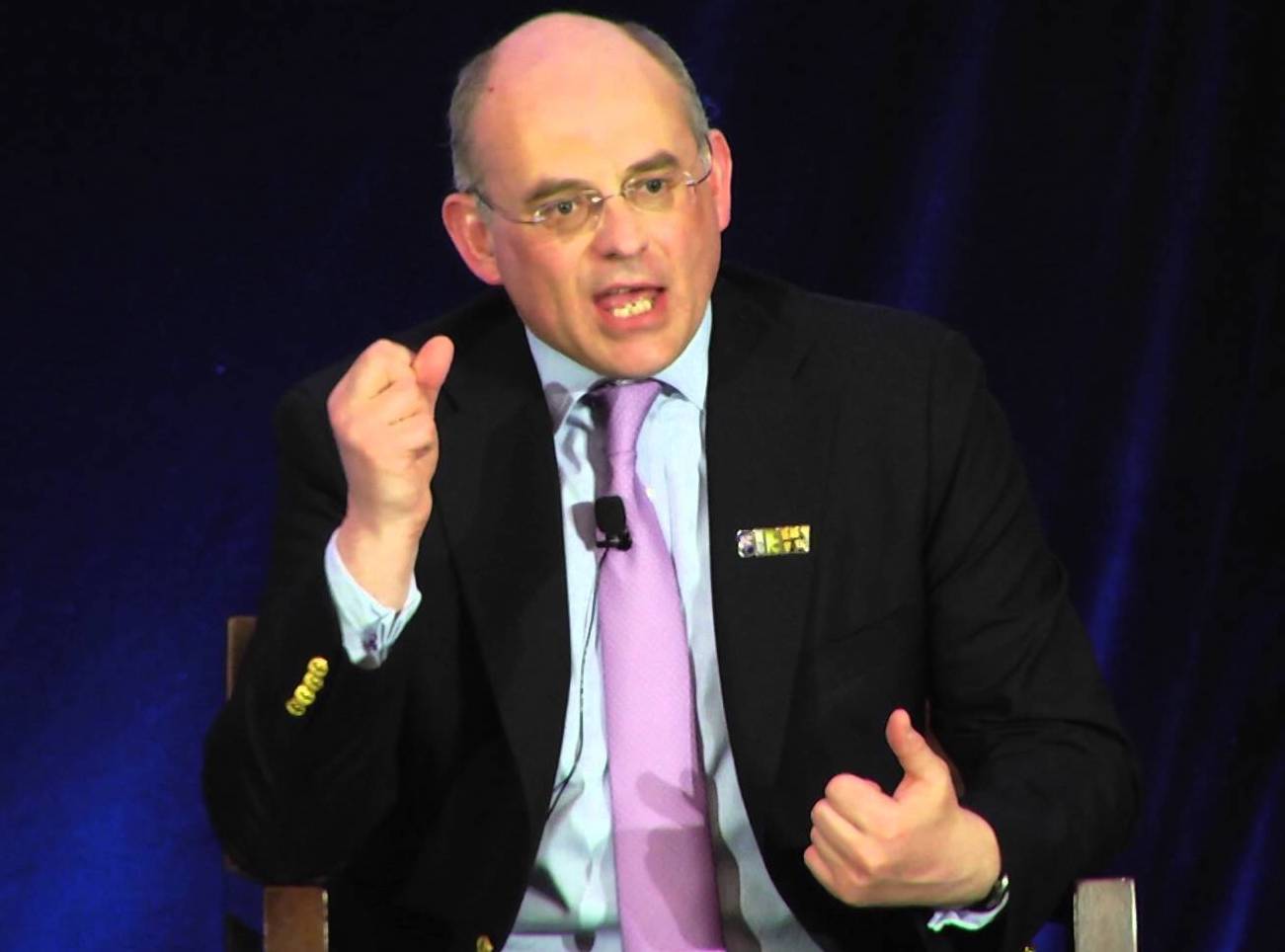

In a Bloomberg Television interview monitored in Lagos Tuesday by businessamlive, Neil Atkinson, IEA head of oil markets and industry division, said if OPEC wishes to achieve the reduction of oil stocks down to the five-year average, it is going to have to dig in for the long haul.

“Rebalancing is a stubborn process,” Atkinson said that “the other challenges facing OPEC on the production side are the two countries, which are not part of the output cut agreement; Libya and Nigeria, which are both seeing production rise.”

See also: Record US shale output keeps OPEC under pressure

OPEC and allies including Russia are curtailing oil output in an effort to deplete bloated inventories and drive up the price of crude. The curbs, which have been extended through next March, have been partly offset by rising supply from Libya and Nigeria, exempt from the cuts, while price gains have spurred drilling from producers in the U.S.

Atkinson said that “the resilience of the U.S. shale producers and the flexibility, the ability to bring on more oil at relatively low cost and short notice, means any signs of life — as far as the price is concerned — encourages more U.S. shale,”

Oil price for now is self-capped as benchmark Brent crude is trading around $50.70 a barrel in London, half its value of three years ago.

The IEA said in a report last week that OPEC’s cutbacks are having some success as global inventories declined at a rate of about 500,000 barrels a day in the second quarter. While that narrowed the surplus, stockpiles were still 219 million barrels above the five-year average at the end of June, the agency said.