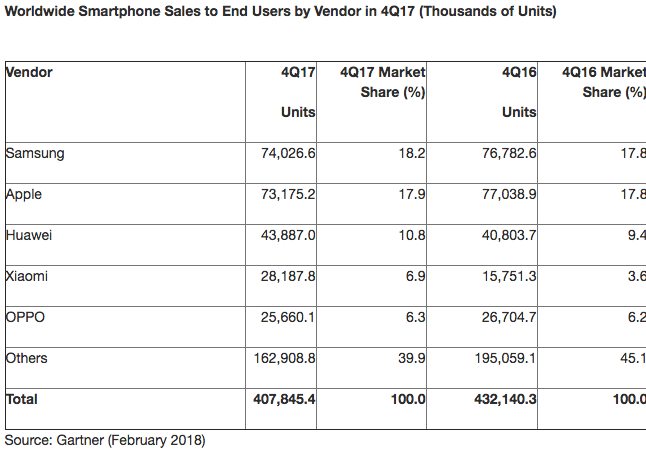

Global sales of smartphones declined by nearly 408 million units in the fourth quarter of 2017, about 5.6 percent decline over the fourth quarter of 2016, according to Gartner Inc.

The sales decline is the first year-on-year decline since Gartner started tracking the global smartphone market in 2004 and it was traced to slow pace of upgrades of feature phones to smartphones and lack of quality ultra-low-cost smartphones.

According to Anshul Gupta, research director at Gartner, two main factors are responsible for the decline including the fact that upgrades from feature phones to smartphones have slowed down due to a lack of quality “ultra-low-cost” smartphones and users preferring to buy quality feature phones as well as fewer replacements since smartphone users are choosing quality models, which last long, thus lengthening the replacement cycle of smartphones.

“Moreover, while demand for high quality, 4G connectivity, and better camera features remained strong, high expectations and few incremental benefits during replacement weakened smartphone sales,” Gupta, said.

Though Gartner figures show first ever drop in worldwide sales, leading phone companies Apple and Samsung saw their market share increase while overall shipments fell with only Chinese manufacturers Xiaomi and Huawei recording growth.

Samsung maintained its position at number one and its market share even increased from 17.8 percent to 18.2 percent. However, shipments fell from 76.8 million to 74 million despite strong sales of the Samsung Galaxy S8 helping increase the average selling price.

Apple is still number two with 73.2 million shipments, down from 77 million, but its market share also rose from 17.8 percent to 17.9 percent. Gartner said Apple’s situation was harmed by component shortages affecting the supply of the iPhone X, while its later release than the iPhone 8 meant many customers delayed their upgrades.

“We expect good demand for the iPhone X to likely bring a delayed sales boost for Apple in the first quarter of 2018,” added Gupta.

Huawei cemented its position as the world’s third-largest smartphone manufacturer with sales rising from 40.8 million to 43.9 million and its market share jumping from 9.4 percent to 10.8 percent.

Xiaomi benefited from strong demand in its homeland and elsewhere to more than double its market share. Sales rose from 15.8 million to 28.2 million and market share increased from 3.6 percent to 6.9 percent.

“Future growth opportunities for Huawei will reside in winning market share in emerging APAC and the US,” concluded Gupta. “Xiaomi’s biggest market outside China is India, where it will continue to see high growth. Increasing sales in Indonesia and other markets in emerging APAC will position Xiaomi as a strong global brand.”