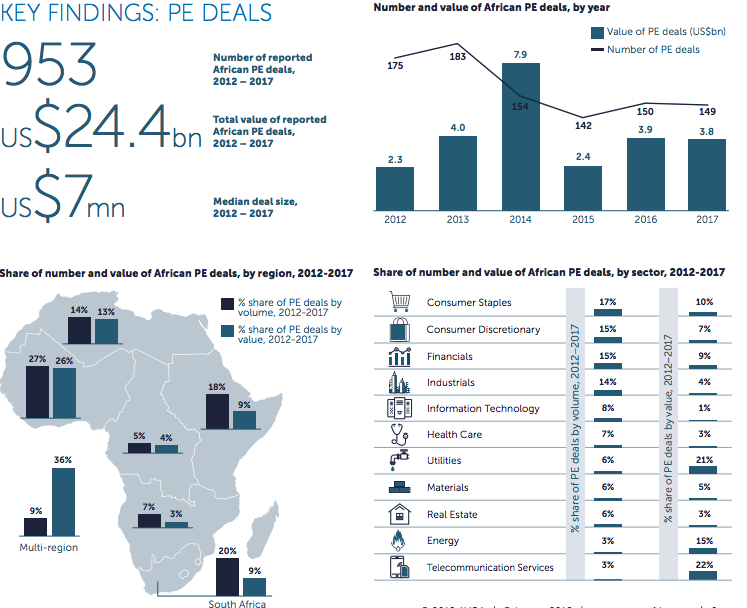

In a period of five years (2012-2017) the value of private equity funding in the West African sub-region rose to $10.7 billion with Nigeria accounting for 73 percent of the total value, according to the 2017 Annual African Private Equity Data tracker published by the African Private Equity and Venture Capital Association (AVCA).

The data tracker seen by businessamlive indicates that the West African region witnessed 267 private equity (PE) deals with Nigeria accounting for 42 percent of the volume of the deals within the period. The country thus leads the region in both volume and value.

Ghana came behind closely, accounting for 27 percent of deals volume and 20 percent of deals value in the sub-region.

Specifically, West Africa’s $10.7 billion PE value represents 43 percent of the $24.4 billion PE value on the African continent.

According to analysts, the numbers are not surprising given the recent $350 million private equity investment in Japaul Oil Plc, the flurry of PE firms that participated in the bid for 9mobile and the entry of Arkana Partners in 2017, which is proposing a $100 million investment into Nigerian mid-cap companies.

Equally, concerted efforts have been made by the government to improve doing business in Nigeria and consequently increase foreign direct investment (FDI) into the country. To that effect, FDI to key sectors of the economy stood at US$4.145bn at the end of the third quarter in 2017 vs. US$3.574bn for the same period in

2016.

The outlook for PE funding into the Nigerian market is also seen bright in 2018 as the country continues to offer a large untapped potential for PE firms amid prohibitive cost of borrowing and the increasingly challenging operating environment.

“This challenge offers PE firms the opportunity to intervene by using their technical competence,” an analyst said.

On the continent, the tracker indicated that PE deal activity remained steady in 2017, despite the total value of African PE fundraising decreasing to US$2.3 billion in 2017 from US$3.4 billion in 2016 as a result of a number of big funds having achieved final closes in prior years.

The report said though consumer discretionary and information technology were the most active sectors for PE deals in Africa in 2016, recent trend of rising PE investments in Africa’s education sector continued in 2017.

It cited Actis’ launch of Honoris United Universities, a pan-African private higher education network as an example.

Nonetheless, the share of PE deals in the information technology sector rose to 15 percent of total PE deals in 2017, from 8 percent in 2015, an increase mainly driven by investments in technology-enabled platforms serving different industries and regions across Africa.

In terms of deal values, materials increased to 17 percent in 2017, from 3 percent in 2016. That was partly the result of a handful of large-sized investments in Africa’s mining sector coming from PE firms outside Africa.