South Africa’s inflation rate fell within the central bank’s target band in April for the first time in eight months, reinforcing chances that the rate-increase cycle may have come to an end.

Consumer-price inflation eased to 5.3 percent from 6.1 percent in March, Statistics South Africa said in a report released Wednesday in the capital, Pretoria. That’s the lowest rate since December 2015 and compares with the median estimate of 5.6 percent by 20 economists surveyed by Bloomberg.

The central bank’s Monetary Policy Committee, which announces its next interest-rate decision Thursday, has kept the repurchase rate unchanged for six meetings after raising it since January 2014 in a bid to keep price growth in its 3 percent to 6 percent target range. All 21 economists in a Bloomberg survey forecast the key lending rate will remain unchanged.

“The Reserve Bank is probably going to acknowledge in tomorrow’s meeting that we have reached the end of the hiking cycle,” Jeffrey Schultz, an economist at BNP Paribas Securities in Johannesburg, said by phone. “Around the September meeting, it could start to communicate that it is considering easing policy rates in the fourth quarter.”

Prices of food and non-alcoholic beverages rose 6.7 percent from a year earlier, the slowest pace since December 2015 and a fourth straight month of deceleration, the statistics agency said. Corn prices have plunged 67 percent since reaching a record in 2016, as the country recovers from the worst drought on record and is set for its biggest harvest of the grain since 1981.

“The downside surprise is likely to fuel stronger calls for a rate-cutting cycle to commence,” Gina Schoeman, an economist at Citigroup Inc. in Johannesburg, said in an emailed note. “Add in extreme global volatility and local political and policy uncertainty and, the SARB will likely keep steadfast in its prudent manner of being certain it would be embarking on a rate-cutting cycle.”

While central bank Governor Lesetja Kganyago said in an interview earlier this month the end of the rate-increase cycle doesn’t mean the regulator will start loosening policy, forward-rate agreements starting in seven months, used to speculate on borrowing costs, show traders are pricing 34 basis points of rate cuts this year. Market commentators were ahead of themselves by forecasting reductions, Kganyago said.

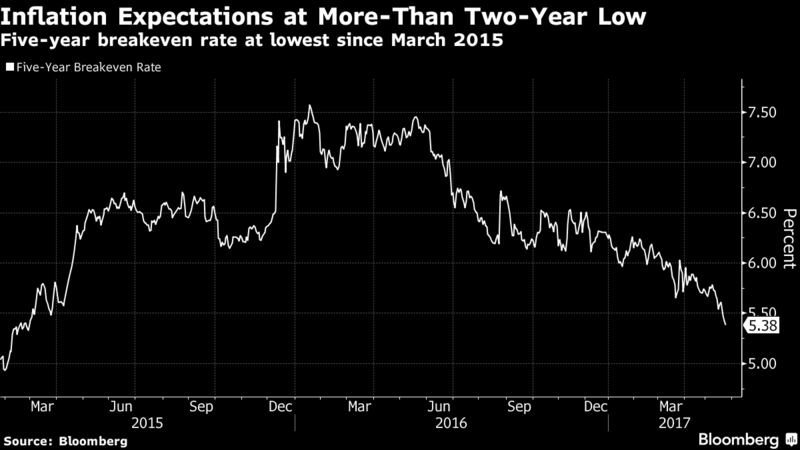

Inflation expectations, as measured by the five-year breakeven rate, are at the lowest in more than two years, standing at 5.38 percent compared with 6.25 percent at the start of the year. The bank projected consumer-price growth would return to within the target band in the second quarter and average 5.9 percent for the year, it said in its March 30 decision.

The economy expanded 0.3 percent last year, the slowest pace since a 2009 recession, due to a slump in commodity prices, weak demand for the country’s exports and a continuation of the worst drought since records began in 1904.

The rand has regained some ground after losing as much as 11 percent against the dollar following President Jacob Zuma’s cabinet changes that saw Pravin Gordhan dismissed as finance minister. That resulted in both S&P Global Ratings and Fitch Ratings Ltd.downgrading the nation’s foreign-currency debt to junk.

This year, the rand has been the most volatile among major and emerging-market currencies tracked by Bloomberg. It gained 0.4 percent to 13.0338 per dollar at 11:36 a.m. in Johannesburg. Yields on rand-denominated government bonds due December 2026 fell 6 basis points to 8.50 percent.

Core inflation, which excludes food, non-alcoholic beverages, energy and gasoline, slowed to 4.8 percent. The median estimate of 11 economists surveyed by Bloomberg was for 4.9 percent.

Courtesy Bloomberg