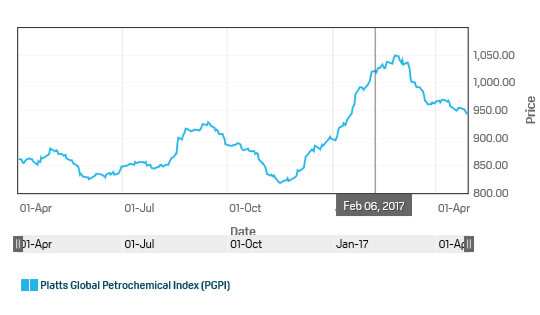

Prices in the $3 trillion-plus global petrochemicals market fell more than 3.5% in April to $958.51 per metric ton (/mt), according to the just-released monthly average of the S&P Global Platts Petrochemical Index (PGPI), a benchmark of seven widely used petrochemicals. This follows a similar drop in prices in March.

On a year-over-year basis, global petrochemical prices were up 11% from the April 2016 average price of $862.48, the Platts data showed. Platts is a leading global energy, petrochemicals and metals information provider and a top source of benchmark price references.

Petrochemicals are used to make plastic, rubber, nylon and other materials for consumer products, packaging, manufacturing, construction, pharmaceuticals, aviation, electronics and nearly every commercial industry.

S&P GLOBAL PLATTS PETROCHEMICAL INDEX IN DOLLARS PER METRIC TON

The daily price reflected as a monthly average

| Apr-17 | Monthly % Change | Annual % Change | Apr-16 | Mar-17 | Feb-17 | Jan-17 | Dec-16 |

| $958.51 | -3.6% | 11.1% | $862.48 | $994.26 | $1,029.18 | $950.40 | $874.44 |

Six of the seven PGPI components traded lower on average in April despite climbing feedstock prices. Crude oil prices in April climbed 2.2%, averaging $52.65/barrel. Naphtha prices were up 2% to $459.92/mt ($51.58/barrel). Ethane prices were up more than 7.5% in April to $3.69/MMbtu.

“Based on the monthly averages, petrochemical prices appear to be moving opposite of the upstream feedstocks. However, both crude and naphtha saw large price spikes at the beginning of April, and have since fallen below where they were at the beginning of April,” said Jim Foster, Director of Global Petrochemical Analytics at Platts. “The petrochemicals tied closely to the barrel of oil – benzene, toluene and paraxylene – showed similar jumps in pricing.”

AROMATICS

Benzene prices were down 1.6% month-on-month to $809.44/mt, but had climbed as high as $860.26/mt during the first week of April. Toluene prices settled slightly higher at $655.59 in April, up $2.17 from March. Paraxylene prices settled 3% lower in April at $815.28/mt, after prices climbed as high as $842.65/mt during the first week of April.

OLEFINS

The largest drop in petrochemical prices were in the global propylene markets, which fell 11.2% to $814.75/mt. The US propylene market – which was being supported earlier in the year by tightness in the market – saw prices drop nearly 40%, which caused to global average to fall so sharply.

Ethylene prices trended higher throughout the month, averaging $1,055.74/mt. That average is still slightly below the March average of $1060.25/mt. In March, prices peaking at nearly $1,132/mt, which pulled the average higher. Through April, global ethylene prices have climbed from $1,025/mt in early April to $1,076/mt by the end of April.

POLYMERS

Polyethylene prices globally were down 1.2% in April to $1,337/mt, down from $1,352.83/mt in March. The price was trending lower for most of the month, despite ethylene prices climbing with feedstocks. Polypropylene prices were down 3.2% to $1,106.64/mt, following upstream propylene prices lower.

PGPI

The PGPI reflects a compilation of the daily price assessments of physical spot market ethylene, propylene, benzene, toluene, paraxylene, low-density polyethylene (LDPE) and polypropylene as published by Platts and is weighted by the three regions of Asia, Europe and the United States.

Used as a price reference, a gauge of sector activity, and a measure of comparison for determining the profitability of selling a barrel of crude oil intact or refining it into products, the PGPI was first published by Platts in August 2007.

Published daily in a real-time news service Platts Petrochemical Alert and other Platts publications, the PGPI is anchored by Platts’ robust and long-established price assessment methodology and the firm’s 100-year history of energy price reporting.

Platts petrochemicals experts are available for media interviews. A sample list of experts may be found at the Platts Media Center. For more information on petrochemicals, click here.