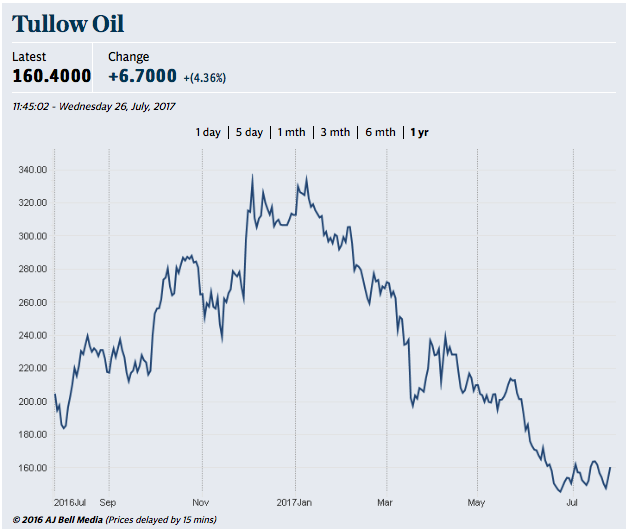

Falling oil price pushes Tullow Oil to £400m loss

July 26, 20171.5K views0 comments

Lower oil prices pushed Tullow Oil into a pre-tax loss of almost £400m in the first half of the year.

The slump in oil prices meant that Tullow was forced to stomach an impairment of property, plant and equipment of $642m (£493m) in the first half of 2017.

After posting pre-tax profits of $24m in the same period last year, Tullow has now revealed losses of $519m.

The swing came despite a 46pc rise in revenues, from $541m to $788m.

Earlier this year the Africa-focused oil explorer turned to shareholders to raise $750m through a rights issue as it looked to manage its debt.

Paul McDade, the chief executive who took the top job in April, said the company had reduced its net debt by around $1bn in the first half to $3.8bn.

“Despite continued challenging market conditions, Tullow performed well in the first half of 2017 delivering strong revenues and organic free cash flow,” he said.

“Combined with the rights issue completed in April, this has allowed us to retain operational and financial flexibility and reduce our debt during the first half by around $1bn.”