Nigeria bans corn imports Forex market

July 13, 20201K views0 comments

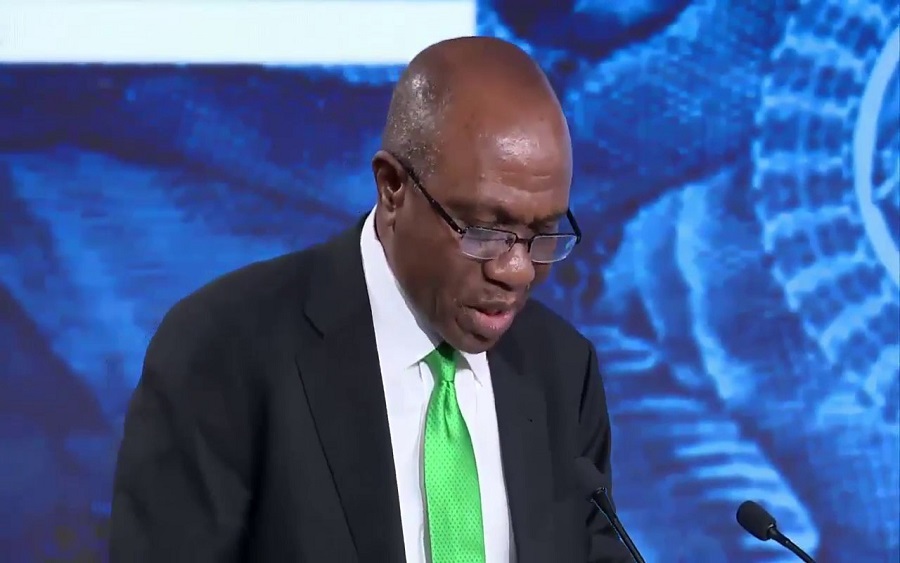

The Central Bank of Nigeria has banned banks in the country from supplying forex to importers of corn and related products in its bid to boost local farming output and block forex leakage, a move that exercabate the already soaring food inflation.

All authorized dealers must immediately stop processing requests for hard currency used for importing corn, the central bank said Monday in a statement on its website.

The announcement is the latest effort by the central bank to shore up local agriculture and manufacturing in an economy that imports fuel, food and raw material for factories. The drop in the price of oil, which accounts for about 90% of Nigeria’s foreign-exchange earnings, means that hard-currency inflows have dried up, putting pressure on the naira and making inward shipments even more expensive.

Read Also:

The halt announced Monday is to “increase local production, stimulate a rapid economic recovery, safeguard rural livelihoods and increase jobs” that were lost due to the coronavirus pandemic, the central bank said. However, a move last year to shut Nigeria’s land borders with its neighbors to curb the smuggling of rice, and later to restrict trade of all goods in an effort to bolster local production, resulted in shortages and price increases.

Rising Inflation

Despite being Africa’s largest producer of corn, Nigeria imports about 400,000 tons each year to meet demand, according to the U.S. Department of Agriculture.

The West African nation’s system of multiple exchange rates means that some importers will still access dollars on the parallel market, though at a much higher rate. That could push up the price of corn, adding to food inflation that’s already at a two-year high of 15%.

“You can expect prices to shoot up,” said Ahmed Jinad, an analyst at Meristem Securities in Lagos. “I don’t think this is a good time to put this policy in place.”