Flour Mills of Nigeria Plc: Earnings upbeat despite lingering cost pressures

August 4, 20171.8K views0 comments

Vetiva Research

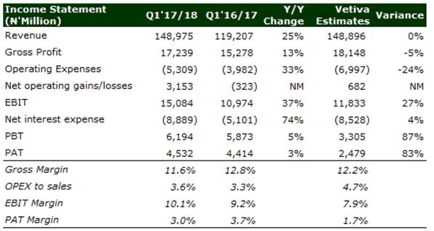

Revenue prints in line with estimate – up 25% y/y

· Gross margin weakness, elevated finance costs remain a challenge

· Gains from FX hedge support Q1’17/18 earnings beat – PAT up 3% y/y

Strong revenue growth persists, PAT rises 3% y/y

Read Also:

- U.S. wine shipments to Nigeria hits record-high $7.8m

- The housing sector and Nigeria’s 21st century economy (2)

- Unenviable place: ‘Nigeria leads world’ in food insecurity

- How dearth of data constitutes a stumbling block to credit access in Nigeria

- Equinix expands digital infrastructure in Nigeria with new Lagos data centre

Despite the strong base from Q1’16/17, FLOURMILL began its FY’17/18 financial year on an impressive note, with Q1’17/18 revenue printing in line with Vetiva estimate at ₦149 billion – up 25% y/y and 11% q/q.

According to Management, the sustained growth was majorly driven by higher volumes and a more favorable product mix across most product categories. Whilst topline grew across all of the Group’s business segments (save for a 42% y/y decline in Real Estate), the strongest boost was served by the 28% y/y and 78% y/y leap in the Food and Packaging segments respectively.

That said, we note that the Group’s topline growth comes in spite of heavy gridlock in Apapa which disrupted operations for weeks.

Amidst a more stable FX environment, gross margin for the quarter came in 176bps higher q/q at 11.6%, albeit below our 12.2% estimate and the 12.8% recorded in Q1’16/17. We believe the sustained uptrend in some raw material prices (wheat and raw sugar) would have capped the recovery in margins.

Also, pressured by one-off charges to administrative expenses (such as expenses incurred on the Apapa road renovation), operating expenses rose 33% y/y to ₦5.3 billion – albeit 24% lower than our estimate.

With this, Core Operating profit came in only 6% higher y/y and 7% above our estimate at ₦11.9 billion. Q1’17/18 earnings were however boosted by a surge in net operating gains to ₦3.2 billion (Vetiva: ₦0.6 billion).

According to management, the exceptional item was as a result of gains from hedged FX positions. With this, EBIT rose 37% y/y to ₦15 billion – 28% above our estimate. This gain was unsurprisingly quickly eroded by the miller’s bloated interest expense line, which rose 74% y/y to ₦8.9 billion (Vetiva: ₦8.5 billion).

This pressure can be attributed to a 22% y/y increase in total borrowings and also higher interest rates on loans (weighted average interest rate: 16% vs. c.10% in FY’15/16). Overall, Q1’17/18 PAT rose by a mild 3% y/y to ₦4.5 billion (Vetiva: ₦2.5 billion).

FY’17/18 earnings estimates, Target Price revised higher

Noting the strong revenue performance recorded in Q1’17/18 in spite of some operational challenges, we are more optimistic on topline growth in the year and revise our FY’17/18 revenue growth estimate slightly higher to 11% (Previous: 9%).

Whilst we expect the cost pressure observed to persist, we are more confident that the miller’s revenue growth will continue to offset the higher cost pressure. As such, we revise our OPEX to sales ratio to 4.0% (Previous: 4.7%).

With this, coupled with the boost from FX gains, we revise our FY’17/18 PAT estimate higher to ₦13 billion (Previous: ₦10 billion). Our 12-month Target Price is revised higher to ₦33.07 (Previous: ₦31.71).

That said, we note that the company is actively trying to improve its debt position through its ₦100 billion Commercial paper issuance program and possibly an equity capital raise.

Furthermore, in a bid to reduce dependence on short term bank facilities, the miller is also working on optimizing working capital position (via increased local aggregation, improved inventory turnover).

Notably, following a reduction in deposits for imports in Q1’17/18, cash flow from operating activities improved by 183% y/y to ₦67 billion with the company paying down ₦51 billion of its debt within the period.

With this, we could see a modest reduction in finance expenses in the coming quarters. However, we remain cautious and maintain our ₦33 billion finance expense estimate for FY’17/18.