NSE total equities transaction value rises 12.5% to hit N2.17trn in 2020

February 4, 2021769 views0 comments

By Charles Abuede

- Total transaction declined by 15.28% to $687.06m from $813.87m in December 2020

- Domestic transactions witnessed advancement to N1.44trn in 2020, despite covid-19 crisis

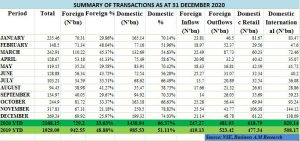

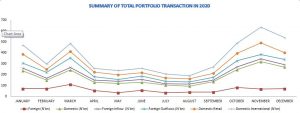

Recent data accessed and analysed by Business A.M. shows that total portfolio investment on the Nigerian equities market rose to N2.17 trillion in 2020 from N1.93 trillion recorded in 2019, amidst the covid-19 pandemic which gave investors reasons to begin seeking returns from other investment options, as well as the weakened participation of foreign investors in the capital market. The performance figures were collated from the Nigerian Stock Exchange for the year-end 2020.

Based on the trading figure from market operators for the year 2020 as reported by the NSE, a total of N729.20 billion, which accounts for 33.63 per cent of the total N2.17 trillion, was transacted by foreigners in the capital market. This represents a decline from N942.55 billion recorded in the corresponding period of 2019. Contrarily, the investment report highlighted that the domestic transactions as at year-end December 2020 saw a positive outcome. It shows that the fervent participation of domestic retail investors have a significant impact on the market. Thus, total domestic transaction stood at N1.44 billion, rising from N985.53 billion generated in the previous year.

Based on the trading figure from market operators for the year 2020 as reported by the NSE, a total of N729.20 billion, which accounts for 33.63 per cent of the total N2.17 trillion, was transacted by foreigners in the capital market. This represents a decline from N942.55 billion recorded in the corresponding period of 2019. Contrarily, the investment report highlighted that the domestic transactions as at year-end December 2020 saw a positive outcome. It shows that the fervent participation of domestic retail investors have a significant impact on the market. Thus, total domestic transaction stood at N1.44 billion, rising from N985.53 billion generated in the previous year.

Furthermore, on monthly analysis, the Nigerian Stock Exchange polled trading figures from market operators on their Domestic and Foreign Portfolio Investment (FPI) flow and the collation outcome shows that during the month of December 2020, total transactions at the nation’s bourse decreased by 15.28 per cent from N317.81 billion (about $813.87 million) in November 2020 to N269.24 billion or $687.06 million in December 2020.

The performance of the current month when compared to the performance in December 2019 (N127.94 billion), according to the NSE, revealed that total transactions increased by 110.44 per cent. In December 2020, the total value of transactions executed by domestic investors outperformed transactions executed by foreign investors by 48 per cent. A further analysis of the total transactions executed between November 2020 and December 2020 revealed that the total domestic transactions decreased by 20.43 per cent from N250.50 billion in November to N199.32 billion in December 2020. However, total foreign transactions increased by 3.88 per cent from N67.31billion or $172.38 million to N69.92 billion, which is equivalent to $178.44 million.

The performance of the current month when compared to the performance in December 2019 (N127.94 billion), according to the NSE, revealed that total transactions increased by 110.44 per cent. In December 2020, the total value of transactions executed by domestic investors outperformed transactions executed by foreign investors by 48 per cent. A further analysis of the total transactions executed between November 2020 and December 2020 revealed that the total domestic transactions decreased by 20.43 per cent from N250.50 billion in November to N199.32 billion in December 2020. However, total foreign transactions increased by 3.88 per cent from N67.31billion or $172.38 million to N69.92 billion, which is equivalent to $178.44 million.

A cursory analysis of the data shows that retail investors in the market were outperformed by the institutional investors by 38 per cent with inflows reaching N86.38 billion for the institutional investors while retail brought in N49.58 billion; and a total of N58.69 billion and N27.81 billion flowed out through the institutional and retail investors, respectively.

Meanwhile, a comparison of domestic transactions in the month of December and November revealed that retail transactions decreased by 42.45 per cent from N106.38 billion in November 2020 to N61.22 billion in December 2020. The institutional composition of the domestic market also decreased by 4.18 per cent from N144.12 billion in November 2020 to N138.09 billion in December 2020 respectively.

Looking into the historical analysis of the domestic and international transactions in the market during the period under review, the data shows that over a fourteen-year period, domestic transactions decreased by 59.54 per cent from N3.56 trillion in 2007 to N1.44 trillion in 2020, whilst foreign transactions surged by 18.45 per cent from N616 billion to N729 billion over the same period. Consequently, total domestic and total foreign transactions accounted for about 74 per cent and 26 per cent of the total transactions in the same period.