OPEC: The cartel’s last stand?

August 17, 20171.6K views0 comments

By Grant Smith

Since its creation more than half a century ago, OPEC has become the textbook case of a successful cartel. The 14-member club of crude exporters, which pumps 40 percent of the oil used every day, has held immense sway over the price of a critical commodity — and the global economy. OPEC’s obituary has been written many times, as waves of new technologies and petroleum discoveries upended the global energy trade. Yet the Organization of Petroleum Exporting Countries has just as often defied its critics. It’s facing a new fight for survival as the U.S., once its biggest customer, unleashes record supplies of shale oil and the planet turns to renewable energy. The group is deploying its most trusted tool — cutting output to boost prices — but whether such tactics can still succeed is unclear.

The Situation

Within months of OPEC’s latest round of production cuts, the price of oil slid as a global supply glut dragged on. That raised doubts about whether the cartel still had the ability to move prices up and keep them there. The selloff persisted as it became clear that some nations, including Iraq, were cheating on their limits. In November 2016, crude had surged back above $50 a barrel when OPEC’s members — which are led by Saudi Arabia and include Iran and Iraq — set aside political divisions to clinch a deal to trim output. The cartel even joined forces with Russia, for years a fierce competitor. The bigger question, though, is whether OPEC’s strategy will be undone by the new wave of U.S. supply. American production bloomed earlier this decade as crude prices above $100 a barrel stimulated investment in “fracking,” or blasting apart underground shale rock to tap the oil or gas trapped within. When this gusher gathered force in 2014, Saudi Arabia’s first strategy was to abandon output limits, expecting that a collapse in prices would thwart the new competition. As shale producers found cheaper ways to operate and the slump dragged on, OPEC returned to its original approach and cut output.

The Background

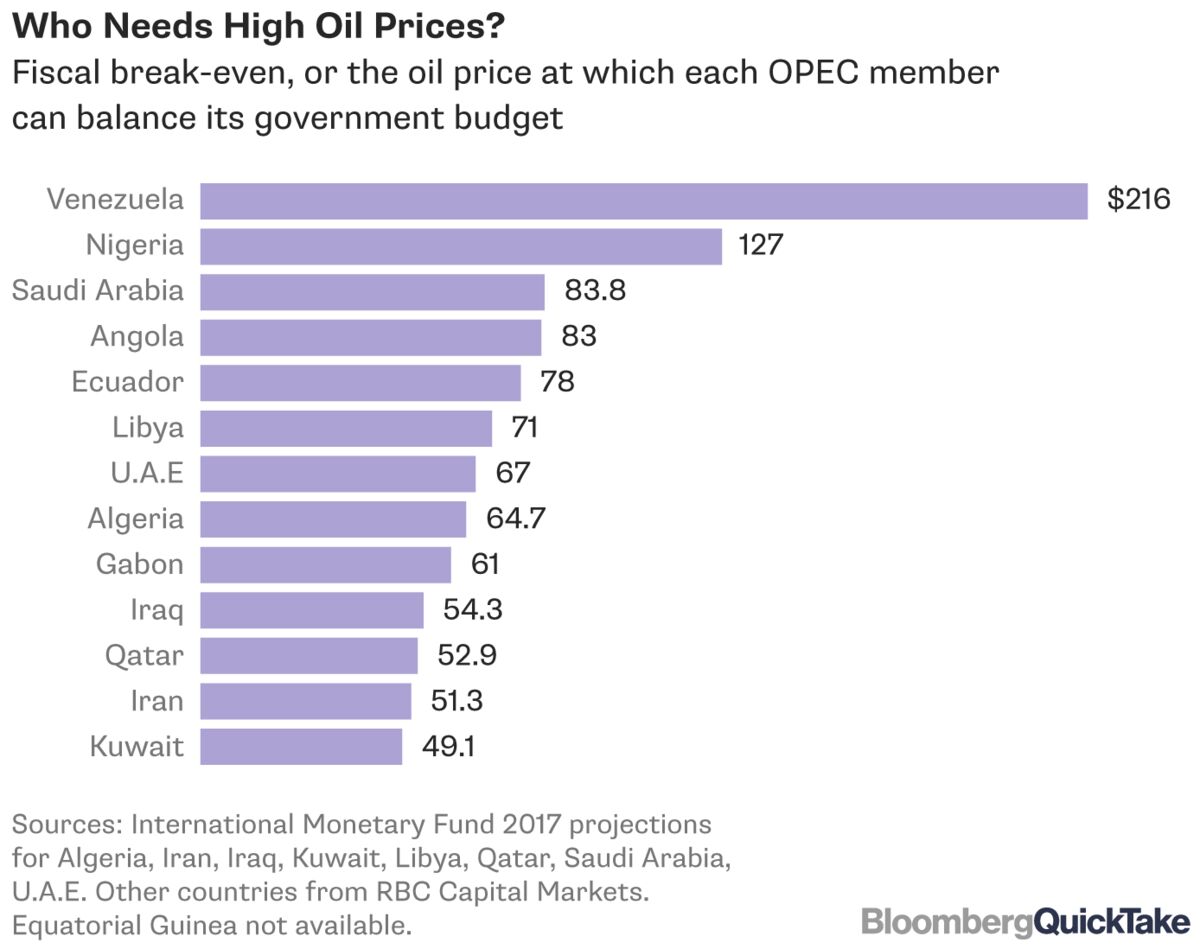

OPEC formed in 1960 when Saudi Arabia, Iran, Iraq, Kuwait and Venezuela sought to wrest control from the giant U.S. and European oil companies that determined the price of crude. It shot to prominence in 1973, when Arab members imposed an oil embargo on western countries in retaliation for their support of Israel. OPEC soon abandoned the practice of using oil for political goals, but continued to operate as the “swing producer,” cutting output when supplies were too high and prices too low, and vice versa. Though OPEC members have some of the lowest production costs on the planet, petrostates rely on high prices to fund government budgets. Several are absolute monarchies that spend lavishly to retain the loyalty of their citizens, while others like Nigeria and Venezuela are volatile countries plagued by corruption and mismanagement. Saudi Arabia is pursuing a partial privatization of its state-run oil company, Aramco, in 2018.

The Argument

On paper at least, the cartel has expanded its powers by building an alliance with another 11 non-OPEC countries that joined its latest supply pact. What’s more, the world’s appetite for oil isn’t going away: Most forecasters expect that consumption will keep expanding for at least another two decades, and any decline will be slow. OPEC’s Middle East members can still produce crude at about a third of the cost of U.S. shale. Yet the group’s inability to sustain higher prices in 2017 advances the view that OPEC lacks the control over the market that it had in the past. There are even signs that the cartel’s strategy is backfiring, as any gains in price spur shale explorers to drill more. Then there’s the growing popularity of electric cars and renewable energy, technology that could mean demand for oil peaks sooner than expected. That could see the cartel’s power slip away forever.

First published on Bloomberg, AUG. 17, 2017